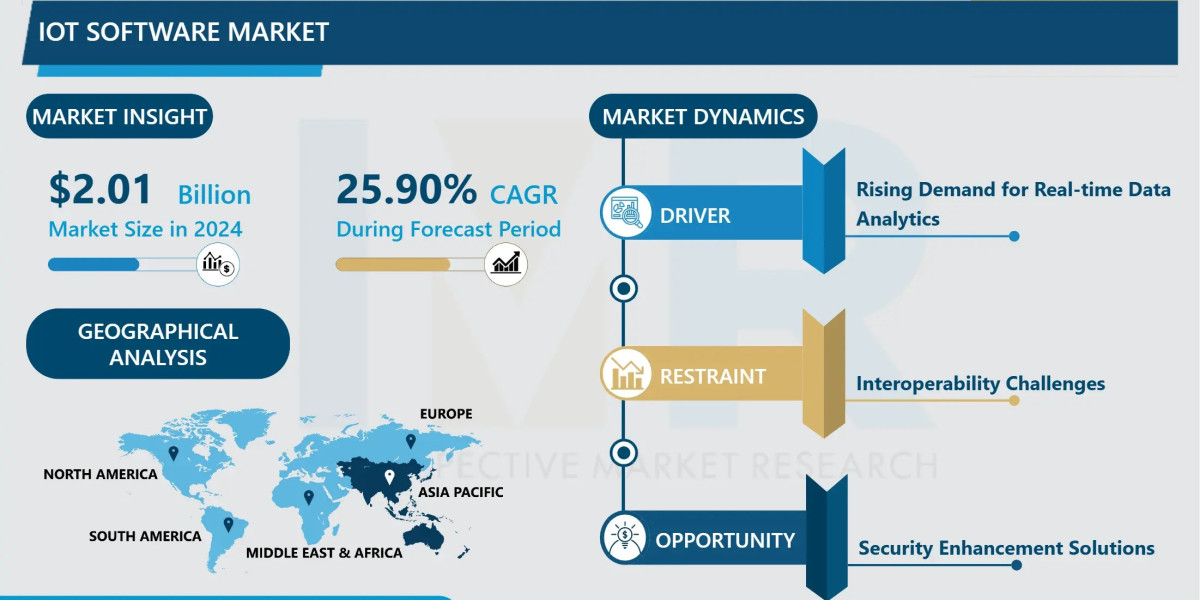

According to a new report published by Introspective Market Research, IoT Software Market by Platform Type, Deployment, Application, and Region, The Global IoT Software Market Size Was Valued at USD 2.01 Billion in 2024 and is Projected to Reach USD 12.69 Billion by 2032, Growing at a CAGR of 25.90%.

Market Overview:

The global IoT Software market encompasses the platforms, applications, and middleware that enable the functionality, connectivity, and intelligence of the Internet of Things (IoT) ecosystem. This includes device management platforms, application enablement platforms, connectivity management software, and advanced analytics tools. The core advantage of modern IoT software over traditional, siloed embedded systems is its ability to unify and orchestrate millions of disparate devices, securely ingest and process massive streams of real-time data, and translate that data into actionable insights and automated actions. This creates a scalable, intelligent, and integrated digital layer over the physical world.

Growth Driver:

The paramount growth driver for the IoT software market is the unprecedented digital transformation across industries, driven by the need for operational efficiency, data-driven decision-making, and the creation of new, connected business models. Businesses are moving beyond pilot projects to large-scale IoT deployments to optimize asset utilization, predict equipment failures, automate complex processes, and gain real-time visibility into their operations. This transformation is underpinned by advancements in complementary technologies like AI/ML (to analyze IoT data), 5G (to enable low-latency, high-bandwidth connectivity), and edge computing (to process data closer to the source). The software layer is essential to harness this technological convergence, making it the central, high-growth component of the entire IoT value chain.

Market Opportunity:

A transformative market opportunity lies in the development of vertical-specific, AI-powered IoT platforms and the expansion of "IoT-as-a-Service" (IoTaaS) offerings. Creating tailored software solutions for high-value verticals such as predictive maintenance suites for manufacturing, integrated clinical command centers for hospitals, or supply chain visibility platforms for logistics can capture significant market share. Furthermore, the rise of IoTaaS, where providers offer bundled hardware, connectivity, software, and analytics on a subscription basis, lowers the barrier to entry for SMEs and accelerates adoption. Integrating Generative AI to allow natural language interaction with IoT systems, automate report generation, and simulate "what-if" scenarios based on real-time sensor data presents a cutting-edge frontier for innovation and differentiation.

IoT Software Market, Segmentation

The IoT Software Market is segmented on the basis of Platform Type, Deployment, and Application.

Platform Type

The Platform Type segment is further classified into Device Management, Application Enablement, Connectivity Management, and Analytics. Among these, the Application Enablement Platform (AEP) segment is a key driver and holds substantial market share. AEPs provide the critical tools to rapidly develop, deploy, and manage IoT applications without deep coding expertise. They are essential for accelerating time-to-value for IoT projects, making them a central and high-growth component of the software stack.

Application

The Application segment is further classified into Manufacturing, Healthcare, Smart Cities, Retail, Agriculture, and Others. Among these, the Manufacturing application segment accounted for the highest market share in 2024. The Industrial IoT (IIoT) segment, particularly smart manufacturing, is the largest adopter. IoT software here drives predictive maintenance, quality control, supply chain optimization, and overall equipment effectiveness (OEE), delivering direct and significant return on investment (ROI), which fuels massive spending.

Some of The Leading/Active Market Players Are-

• Microsoft Corporation (Azure IoT) (USA)

• Amazon Web Services, Inc. (AWS IoT) (USA)

• Google LLC (Google Cloud IoT) (USA)

• IBM Corporation (USA)

• Siemens AG (Germany)

• PTC Inc. (USA)

• SAP SE (Germany)

• Cisco Systems, Inc. (USA)

• Oracle Corporation (USA)

• Software AG (Germany)

• Bosch.IO GmbH (Germany)

• Hitachi, Ltd. (Japan)

• Ayla Networks (USA)

• Telit (USA)

• Eurotech S.p.A. (Italy)

• and other active players.

Key Industry Developments

News 1:

In March 2024, Microsoft launched new generative AI capabilities within its Azure IoT platform, allowing engineers to use natural language prompts to build data pipelines, create anomaly detection rules, and generate operational reports from live sensor data, significantly simplifying IoT solution development.

News 2:

In February 2024, Siemens and AWS announced a strategic expansion of their partnership to offer a fully integrated industrial IoT suite. The solution combines Siemens' industrial automation and edge devices with AWS's cloud and AI analytics, targeting end-to-end digital twin and autonomous production line use cases for manufacturers.

Key Findings of the Study

• The Manufacturing (IIoT) application segment dominates, driven by the strong ROI from operational efficiency gains.

• North America holds the largest market share due to early technology adoption and the presence of major cloud and software providers.

• The overarching digital transformation of industries and the convergence of IoT with AI and 5G are the primary growth drivers.

• Major trends include the shift towards vertical-specific platforms, the growth of IoTaaS models, and the deep integration of AI/ML for predictive and generative analytics.