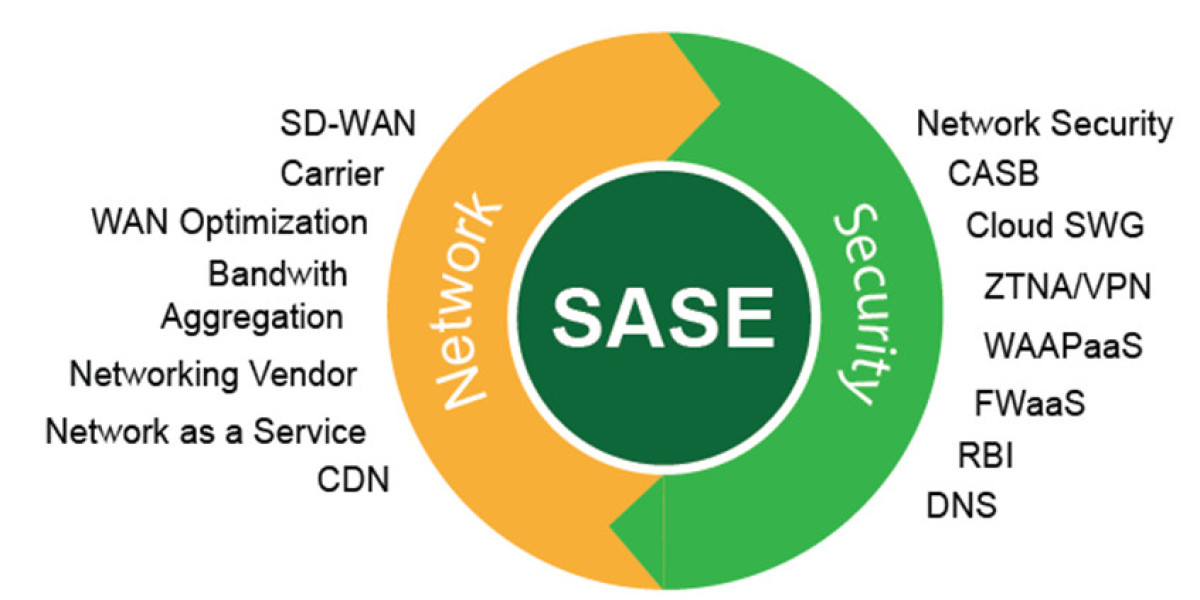

Mergers and acquisitions (M&A) are not just a feature of the Secure Access Services Edge (SASE) market; they are the very mechanism by which the market itself has been constructed. A strategic analysis of the most significant Secure Access Services Edge Market Mergers & Acquisitions reveals a clear and deliberate pattern: the convergence of networking and security through the acquisition of complementary technologies. The leading security vendors have been buying SD-WAN companies, and networking companies have been buying security companies, all in a race to assemble a complete, single-vendor SASE platform. This M&A frenzy is a direct result of the SASE framework itself, which posits that these two previously separate domains must be unified into a single, cloud-delivered service. The market's explosive growth provides the financial justification for these multi-billion-dollar deals. The Secure Access Services Edge Market size is projected to grow USD 42.86 Billion by 2035, exhibiting a CAGR of 22.1% during the forecast period 2025-2035. This expansion fuels a dynamic M&A landscape where the "buy versus build" calculation is almost always in favor of "buy" for any company looking to rapidly fill a critical gap in its SASE portfolio.

The most prominent M&A trend has been the acquisition of leading SD-WAN vendors by major platform security companies. This was a critical step for these companies to be able to offer a true, single-vendor SASE solution. The landmark deal in this category was Palo Alto Networks' acquisition of CloudGenix. Palo Alto Networks, a leader in next-generation firewalls, recognized that to deliver on the SASE vision, it needed a strong networking component. By acquiring CloudGenix, a leader in the Gartner Magic Quadrant for SD-WAN, it instantly gained a best-in-class SD-WAN solution that it could then integrate with its existing Prisma Access cloud security platform to create the comprehensive Prisma SASE offering. Other major security players have followed a similar playbook. Fortinet, while having strong organic SD-WAN capabilities, has also made acquisitions to bolster its portfolio. This trend highlights the strategic realization that a credible SASE story requires a credible networking story, and M&A was the fastest path to achieve it.

On the other side of the coin, we have seen networking companies acquire security capabilities, although this has been a somewhat more challenging path. Cisco, the giant of enterprise networking, has built its SASE offering through a series of major security acquisitions over the years, including OpenDNS (which became Cisco Umbrella, a key SWG component), Duo Security (for multi-factor authentication and ZTNA), and others. Its strategy has been to assemble a portfolio of best-of-breed security tools to complement its market-leading networking portfolio (Meraki, Viptela). Looking forward, M&A in the SASE market will likely focus on acquiring smaller, innovative companies with cutting-edge technology in specific areas of the Security Service Edge (SSE) stack. This could include startups with superior technology for data loss prevention (DLP), digital experience monitoring (DEM), or AI-powered threat detection. As the major platforms mature, M&A will shift from large-scale architectural acquisitions to smaller, "tuck-in" deals designed to add specific features and maintain a technological edge in a fiercely competitive market.

Top Trending Reports -

Germany Iot Public Safety Market