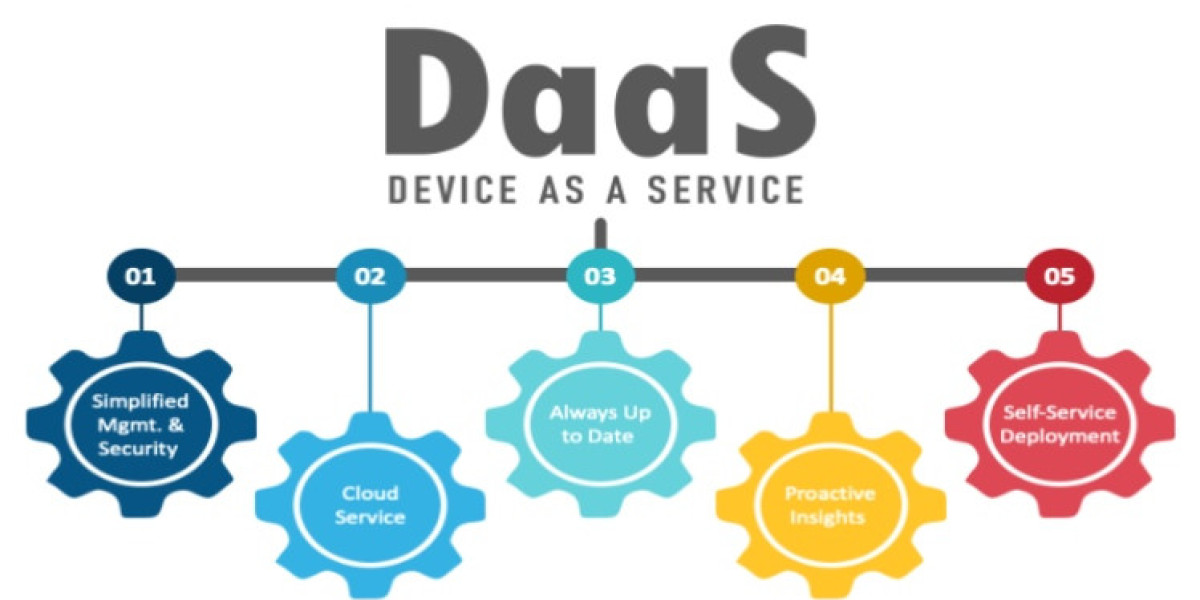

The mergers and acquisitions (M&A) landscape that is shaping the Device as a Service (DaaS) market is a strategic and often subtle affair, focused more on capability acquisition than on the consolidation of major competitors. A strategic analysis of Device as a Service Market Mergers & Acquisitions and related investments reveals that the primary M&A activity is not about the major OEMs buying each other, but about these OEMs and large service providers acquiring smaller, specialized companies to enhance their service portfolios and technological capabilities. In a market where the "service" component is the key differentiator, M&A is being used as a critical tool to rapidly acquire expertise in areas like device management software, security, and sustainable IT asset disposition (ITAD). The market's substantial growth provides the financial impetus for this activity. The Device as a Service Market size is projected to grow USD 1804.35 Billion by 2035, exhibiting a CAGR of 25.64% during the forecast period 2025-2035. This expansion fuels a dynamic M&A environment where the market leaders are constantly looking to "buy" the innovative technologies and specialized skills they need to create a more comprehensive and competitive DaaS offering.

The most common theme in M&A related to the DaaS market is the acquisition of companies that provide a specific, value-added service in the device lifecycle. A major OEM or a large system integrator might acquire a company that has developed a superior software platform for unified endpoint management (UEM) or a company with advanced AI-powered predictive analytics for monitoring device health. These are technology "tuck-in" acquisitions designed to bolster the software and intelligence layer of the DaaS platform. Another key area of M&A is in IT Asset Disposition (ITAD). The responsible and secure disposal or refurbishment of end-of-life devices is a critical component of the DaaS model. To strengthen their capabilities in this area, a major player might acquire a specialized ITAD firm that has a strong network of certified recycling facilities and a proven track record in secure data destruction. This type of vertical integration allows the DaaS provider to have greater control over the end-to-end lifecycle and to offer a more robust and compliant service to its clients, particularly those with stringent data security and sustainability requirements.

Looking forward, M&A activity is likely to focus on several emerging areas that are becoming increasingly important to the DaaS value proposition. One such area is digital employee experience (DEX) management. As companies focus more on employee productivity and satisfaction in a hybrid work environment, tools that can monitor and improve the digital experience of employees are becoming highly valuable. A DaaS provider might acquire a DEX software company to integrate these capabilities directly into its offering, allowing it to move beyond just managing the device to managing the entire employee experience with that device. Another potential area for M&A is in specialized security services. This could include acquiring a company with expertise in mobile device security or a firm that offers managed threat detection and response for endpoints. By bundling these advanced security services into their DaaS offering, the providers can create a more secure and compelling solution. The overall M&A strategy in the DaaS market is not about creating a bigger hardware company, but about assembling the diverse set of software and service capabilities needed to deliver a complete, intelligent, and secure managed device experience. The Device as a Service Market size is projected to grow USD 1804.35 Billion by 2035, exhibiting a CAGR of 25.64% during the forecast period 2025-2035.

Top Trending Reports -

China Iot Public Safety Market