The integration of electronics into vehicles has created one of the largest and fastest-growing technology markets in the world. The Automotive Electronics Market Size represents the total annual global revenue generated from the sale of all electronic components, systems, and related software for vehicles. As of late 2025, this valuation is staggering, measured in the many hundreds of billions of US dollars, and is on a clear trajectory to potentially exceed a trillion dollars before the end of the decade. This immense market size reflects the fundamental shift of value in the automotive industry—away from traditional mechanics and towards sophisticated digital technology.

Calculating the Market's Value

The market size is essentially the sum total of the value of all electronic hardware and software content within every vehicle produced, plus the related aftermarket sales. Key factors driving this valuation higher are:

Increasing Electronic Content per Vehicle: This is the most crucial driver. A decade ago, electronics might have represented 20-25% of a car's total cost. In a modern, high-feature electric vehicle, this figure can approach 50%. This dramatic increase in the value per vehicle is the main engine of market size growth.

Growing Global Vehicle Production: While growth rates vary, the overall global production of vehicles provides a massive base volume for the market.

Higher Value Components: The shift towards complex systems like ADAS, large high-resolution displays, powerful central computers (SoCs), and advanced power electronics for EVs involves components with significantly higher price tags than the simple electronics they replace.

Market Size by Key Application Domains The total market value is an aggregation of several high-value segments:

ADAS & Autonomous Driving: Currently the fastest-growing segment in terms of value, driven by the proliferation of sensors (cameras, radar, LiDAR) and the extremely high cost of the powerful AI processors required.

Infotainment & Connectivity: A massive segment driven by consumer demand for large screens, sophisticated HMI, and seamless connectivity features.

Powertrain Electronics: This remains a huge segment, encompassing traditional engine/transmission controllers but increasingly dominated by the high-value electronics required for EVs (Battery Management Systems, inverters, on-board chargers).

Body & Convenience Electronics: While individual components are lower cost, the sheer volume of controllers for lighting, climate, access, etc., makes this a substantial market.

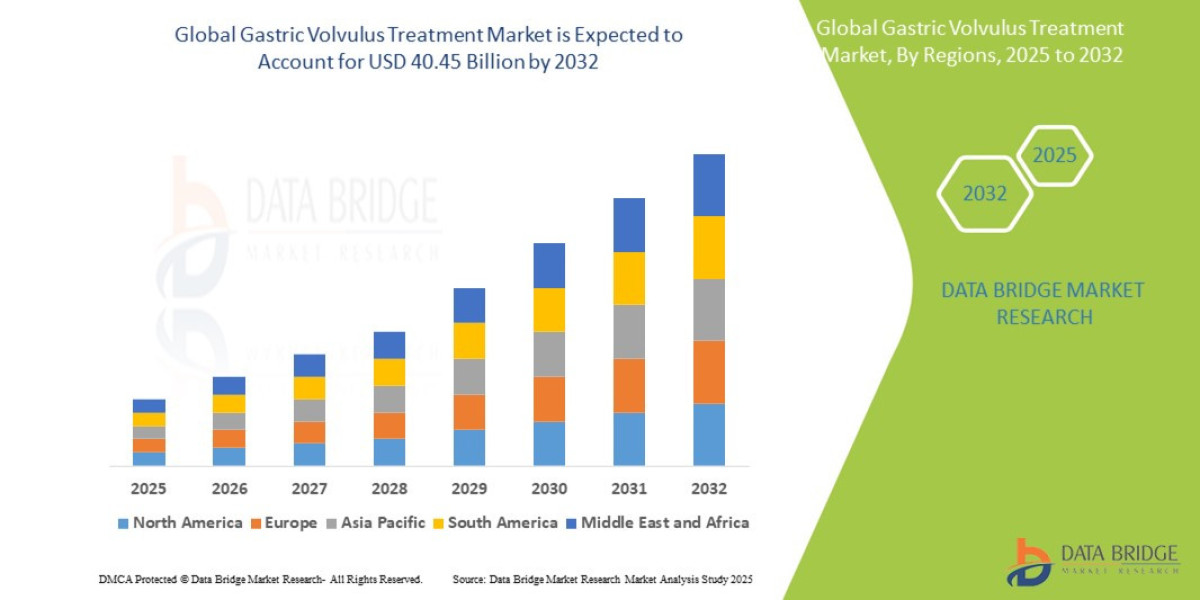

Regional Dominance The Asia-Pacific region, led by China's colossal automotive market and strong electronics manufacturing base, represents the largest regional market size. Europe, with its focus on premium vehicles and advanced technology, and North America are also massive contributors to the global valuation.

Frequently Asked Questions (FAQ)

Q1: How big is the global automotive electronics market?A1: As of 2025, the global automotive electronics market is valued at well over $300 billion USD annually, with some forecasts projecting it to approach or exceed $1 trillion USD by 2030 due to rapid growth.

Q2: Which part of the car contributes most to the electronics market size?A2: The fastest-growing and increasingly dominant segments in terms of value are Advanced Driver-Assistance Systems (ADAS) and Infotainment & Connectivity, as these require the most sophisticated and expensive sensors and processors. EV Powertrain electronics are also a massive contributor.

Q3: Is the market still expected to grow?A3: Yes, phenomenal growth is projected for the foreseeable future. The ongoing trends of electrification, automation, and connectivity will continue to dramatically increase the electronic content and value within each new vehicle produced.

More Related Report

Mobile Food Truck Market Trends