CNG Tanks Industry: Insights into the CNG tanks industry, including technological innovations and manufacturing trends.

The CNG Tanks Industry, encompassing manufacturers, raw material suppliers, and certification bodies, operates at the intersection of materials science, high-pressure engineering, and automotive safety standards. Its qualitative features are defined by specialization, rigorous safety requirements, and an intensive focus on weight-to-performance optimization.

Specialization and Manufacturing Complexity are defining characteristics. Manufacturing high-pressure vessels, especially the advanced composite types, is a process demanding highly specialized equipment, expertise in filament winding technology, and adherence to extremely strict quality control protocols. The industry is not commoditized; it is characterized by a relatively small number of global players who possess the technological know-how for composite tank production (Type III and IV), which grants them a competitive qualitative advantage. This specialization extends to the raw material supply chain, particularly for high-grade carbon fiber and specialized resins, which dictates the industry's cost structure and responsiveness to demand surges.

Safety and Regulatory Compliance form the most critical qualitative barrier to entry and a non-negotiable aspect of the industry. CNG tanks operate at extremely high pressures (typically around 200 bar or 3,000 psi), necessitating exhaustive testing and certification to global standards such as ISO, ECE R110, and various national standards. Every design iteration, material change, and manufacturing process must be rigorously qualified against criteria for impact resistance, fire safety, pressure cycling fatigue, and long-term durability. The requirement for a fixed service life (typically 15 to 20 years) for each tank, after which it must be decommissioned, is a unique feature that inherently creates a future replacement market for manufacturers.

Industry Segmentation by Tank Type is a key qualitative structural feature. The four cylinder types represent a spectrum of performance, complexity, and target application:

Type I (All-Metal): Known for robustness, low initial cost, and long service life. Primarily used in stationary storage and bulk transport where weight is not a constraint.

Type II (Hoop-Wrapped): A metal liner reinforced with a composite wrap in the cylindrical section, offering a slight weight advantage over Type I.

Type III (Fully Wrapped, Aluminum Liner): Significantly lighter, primarily for vehicle applications. The aluminum liner provides a gas-tight seal, with the composite wrap (usually carbon fiber) bearing most of the structural load.

Type IV (Fully Wrapped, Non-Metallic Liner): The lightest and most advanced type, using a plastic (polymer) liner for the gas barrier and an all-composite wrap for strength. This type offers the maximum weight savings essential for passenger and commercial vehicle range extension.

The shift toward lightweighting is the industry's most powerful qualitative trend. In the automotive sector, every kilogram saved directly translates to better fuel economy, lower emissions, and improved vehicle performance. This demand exerts constant pressure on the industry to innovate in composite materials and manufacturing efficiency, pushing for greater adoption of Type IV tanks. This focus creates a qualitative rivalry between steel/aluminum suppliers and composite manufacturers, with the latter increasingly gaining dominance in the profitable on-board vehicle segment.

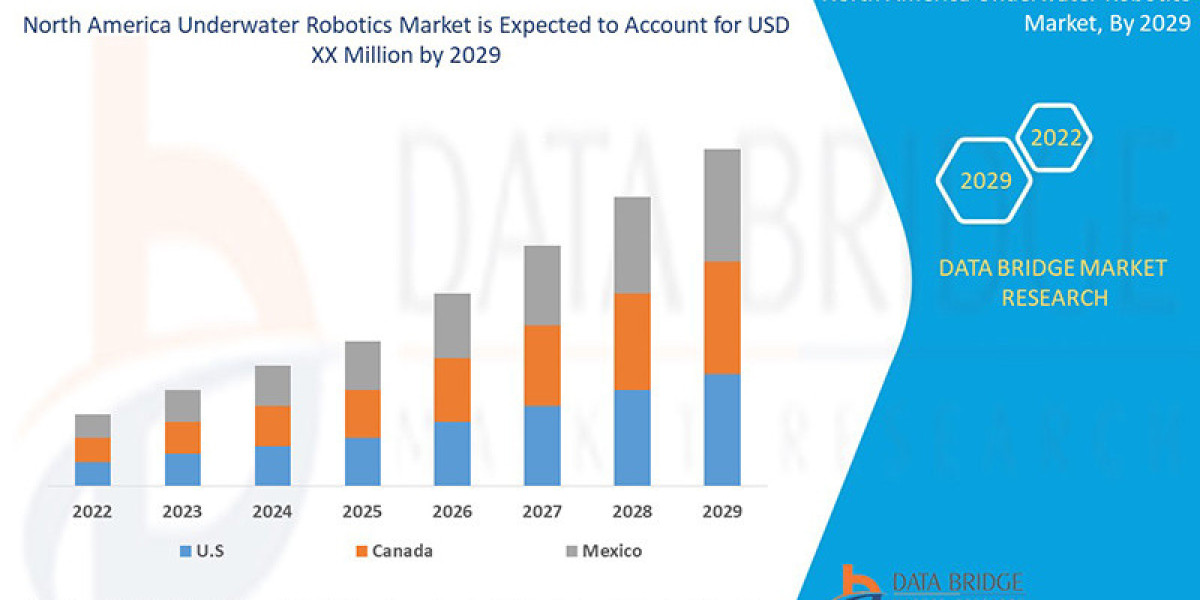

Global Distribution and Regional Dynamics influence the industry landscape. Regions with proactive government policies promoting natural gas vehicles, such as the Asia-Pacific (especially India and China), represent the primary growth hubs for tank manufacturing. The presence of a mature natural gas infrastructure and a large base of three-wheelers, buses, and passenger cars in these regions drives high-volume production, often favoring lower-cost Type I and Type II cylinders, although the uptake of Type III and IV is accelerating for performance-driven applications. Conversely, established markets in North America and Europe, which have stringent safety standards and a strong push for weight reduction in high-end commercial fleets, focus more on advanced Type III and IV composite cylinders.

In summary, the CNG Tanks Industry is a technologically sophisticated sector defined by non-negotiable safety standards, a clear trend towards advanced composite materials for weight reduction, and a fragmented global structure tied to regional NGV adoption policies and natural gas infrastructure maturity.

Frequently Asked Questions (FAQ)

Q1: What is the most critical qualitative factor defining competition in the CNG tanks industry?

A1: The most critical factor is the ability to produce certified, lightweight, high-performance composite tanks (Type III and IV) efficiently. This technological capability directly affects a vehicle's range and payload, giving manufacturers with advanced materials expertise a significant competitive edge over those relying solely on traditional metal tank production.

Q2: How does the "service life" of a CNG tank impact the industry?

A2: The mandatory, finite service life (e.g., 15 or 20 years) for CNG tanks, after which they must be replaced, inherently establishes a long-term, cyclical replacement market. This ensures continuous, albeit staggered, demand for new tanks and is a unique qualitative feature of the industry compared to other vehicle components.

Q3: What role does high-pressure engineering play in the CNG tanks industry?

A3: High-pressure engineering is fundamental, as it dictates the tank's core function: safely storing gas at pressures up to 250 bar (3,600 psi). It drives all material selection, design principles (such as cylindrical shape for stress distribution), and manufacturing processes like filament winding, making it central to product safety and regulatory compliance.