Innovations and Growth in the Commercial Loan Software Market

The commercial loan software market is rapidly evolving as financial institutions look for advanced solutions to streamline their lending processes. With the increasing complexity of commercial lending, banks and other financial organizations are adopting software platforms that improve loan origination, processing, and risk management. These solutions not only enhance operational efficiency but also help in maintaining compliance with regulatory requirements.

Key Drivers of Market Expansion

Several factors are fueling the adoption of commercial loan software:

Digital Transformation in Banking: Banks are investing heavily in technology to automate loan workflows, reduce manual errors, and enhance customer satisfaction.

Rising Demand for Credit Intermediation: The need for efficient credit intermediation processes is driving the adoption of commercial loan software, enabling lenders to manage multiple credit channels and reduce operational costs.

Regulatory Compliance: Stringent regulations require accurate reporting and documentation, which commercial loan software efficiently manages.

Integration with Insurance and Risk Management

Commercial loan platforms are increasingly being integrated with risk assessment tools and insurance solutions:

Compulsory Third Party Insurance: The integration with compulsory third party insurance systems ensures that loans are compliant with insurance regulations, mitigating financial risks for both lenders and borrowers.

Advanced Analytics: Modern software solutions offer predictive analytics, helping banks forecast defaults, assess borrower creditworthiness, and optimize loan portfolios.

Technological Trends

The market is witnessing significant technological innovations:

Cloud-Based Platforms: Cloud adoption allows for scalable, secure, and real-time access to loan data, enabling banks to process loans more efficiently.

AI and Automation: Artificial intelligence assists in automating repetitive tasks, fraud detection, and personalized loan offerings, further improving operational efficiency.

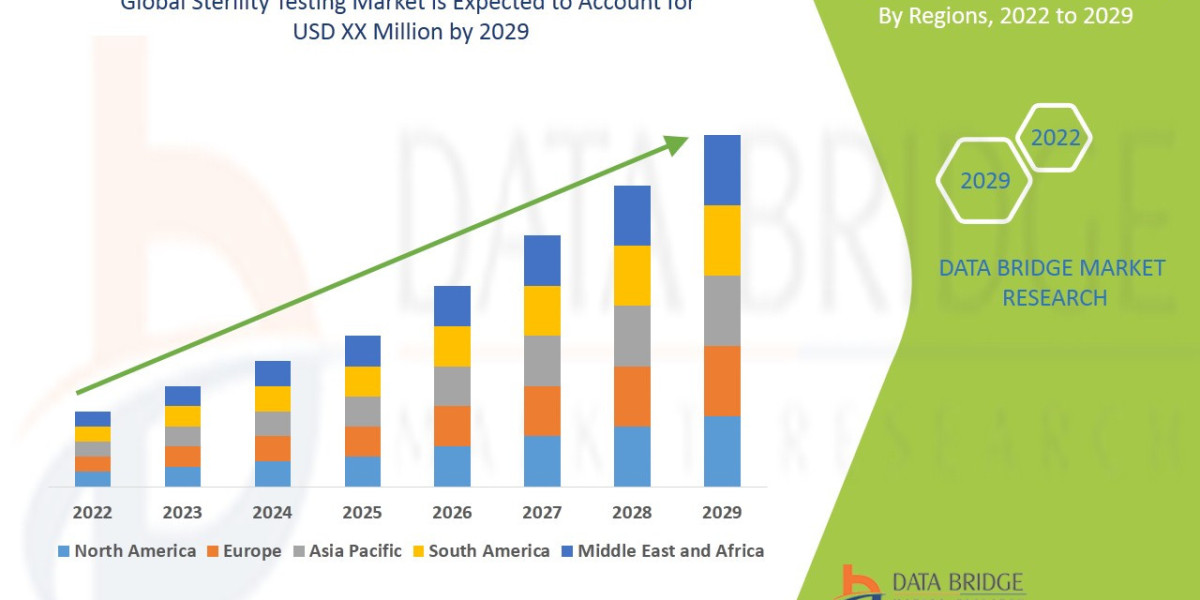

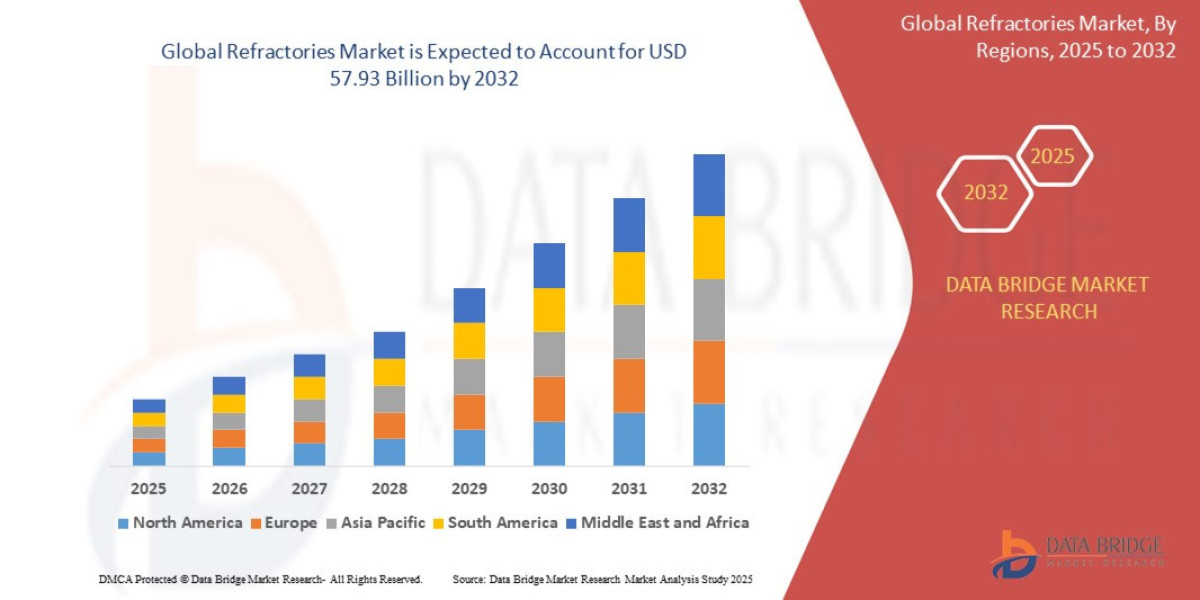

Regional Outlook

North America and Europe: Lead the market due to advanced banking infrastructure and early adoption of commercial loan software.

Asia-Pacific: Expected to show strong growth, driven by expanding banking sectors and increased focus on digitization.

Conclusion

The commercial loan software market is poised for sustained growth as financial institutions continue to modernize their lending operations. By integrating advanced analytics, insurance compliance, and credit intermediation capabilities, these platforms provide comprehensive solutions that reduce risk, improve efficiency, and enhance customer satisfaction. The convergence of technology and regulatory compliance is setting the stage for a more streamlined and efficient commercial lending landscape.